For many Australian businesses, international trade isn’t the exception — it’s the norm. Whether you’re importing goods, selling services overseas, or managing suppliers in multiple countries, dealing with multiple currencies is part of daily operations.

Odoo’s multi-currency features are designed to handle international transactions seamlessly across sales, purchases, and accounting. With automated exchange rate updates, accurate currency conversions, and proper tracking of gains and losses, Odoo makes it easy to manage a global business — all from a single platform.

The Benefits of Multi-Currency in Odoo

Odoo is designed to simplify all of this by giving you real-time, automated currency management directly within your accounting, invoicing, sales, and purchasing flows.

Odoo’s multi-currency engine works smoothly across modules:

- Enable multiple currencies—then transactions like invoices, bills, payments, and bank entries can be created in any active currency.

- Exchange rates update automatically (daily, weekly, or manually), with sources like ECB or Yahoo.

- Odoo stores both the foreign and base currency values, showing both in transaction lines and during reconciliation.

- Gains or losses from rate changes are automatically posted via journals when payments are registered or reconciled.

- Dedicated bank journals can be assigned specific currencies, enabling clear reporting on foreign‑currency bank accounts

Financial statements remain consistent and audit-ready, even across multiple currencies.

In short, Odoo helps Australian businesses reduce risk, save time, and operate confidently across international markets — whether you’re selling to Sydney or Singapore.

Enabling Multi‑Currency in Odoo

Before you can send invoices or process payments in multiple currencies, you’ll need to enable multi-currency support and configure your preferred currencies in Odoo. Here's how to get started:

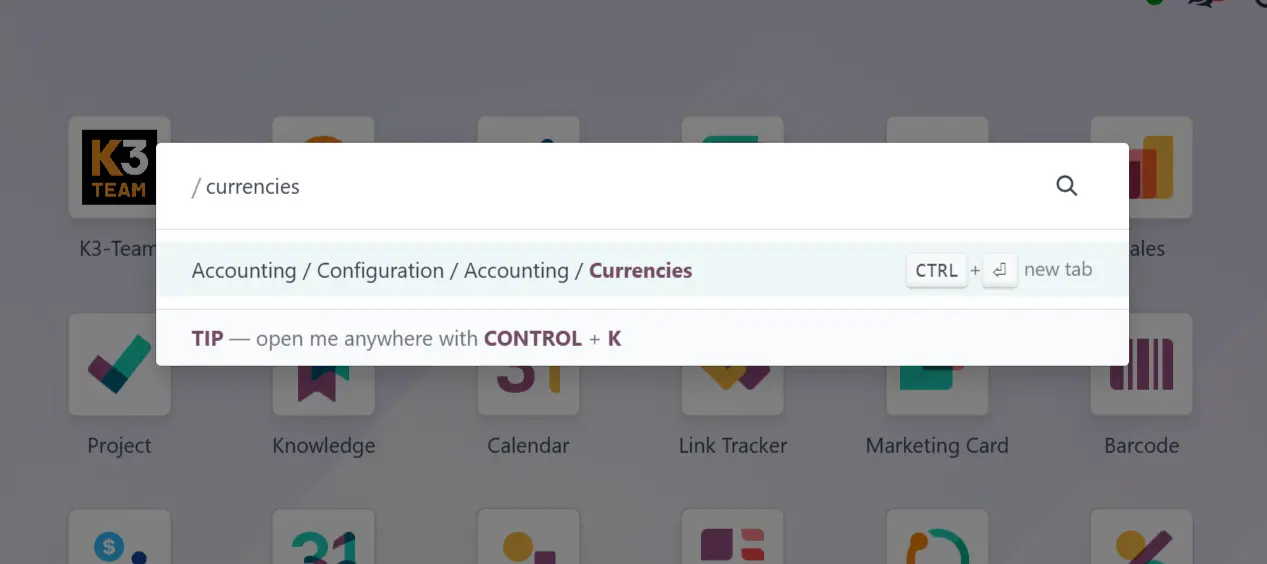

Access Currency Settings

From the Odoo dashboard, simply start typing currencies — no need to press any shortcut.

Odoo will instantly bring up the Currencies menu (As shown in screenshot, this quick access lets you jump directly to currency settings.):

Accounting / Configuration / Accounting / Currencies

Activate the Currencies You Need

You’ll now see a full list of available currencies (Screenshot 2). To enable specific ones:

- Go to Accounting → Configuration → Currencies.

- Find the currency you need (e.g. USD, EUR, GBP).

- Toggle the “Active” switch to green next to each one.

How to Use Currencies in Sales (e.g. Quotations & Invoices)

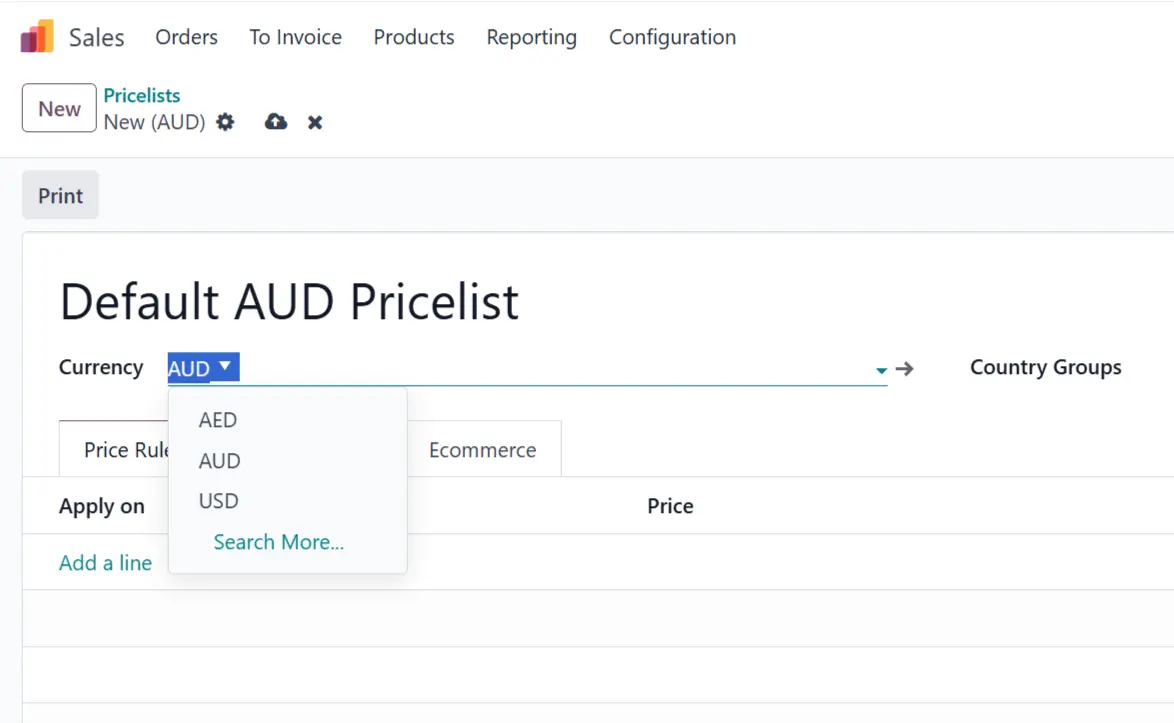

To use a foreign currency in a quotation or invoice, you first need to create a pricelist in that currency. Only after that will it be available for selection during sales operations.

- Go to Sales → Products → Pricelists.

- Click “New” to create a new pricelist.

- Name it (e.g. Default USD Pricelist).

- Choose the currency you want to use (e.g. USD).

- Define any pricing rules (or leave as is for standard prices).

- Save.

💡 Once created and active, this pricelist will appear in the sales order or quotation form.

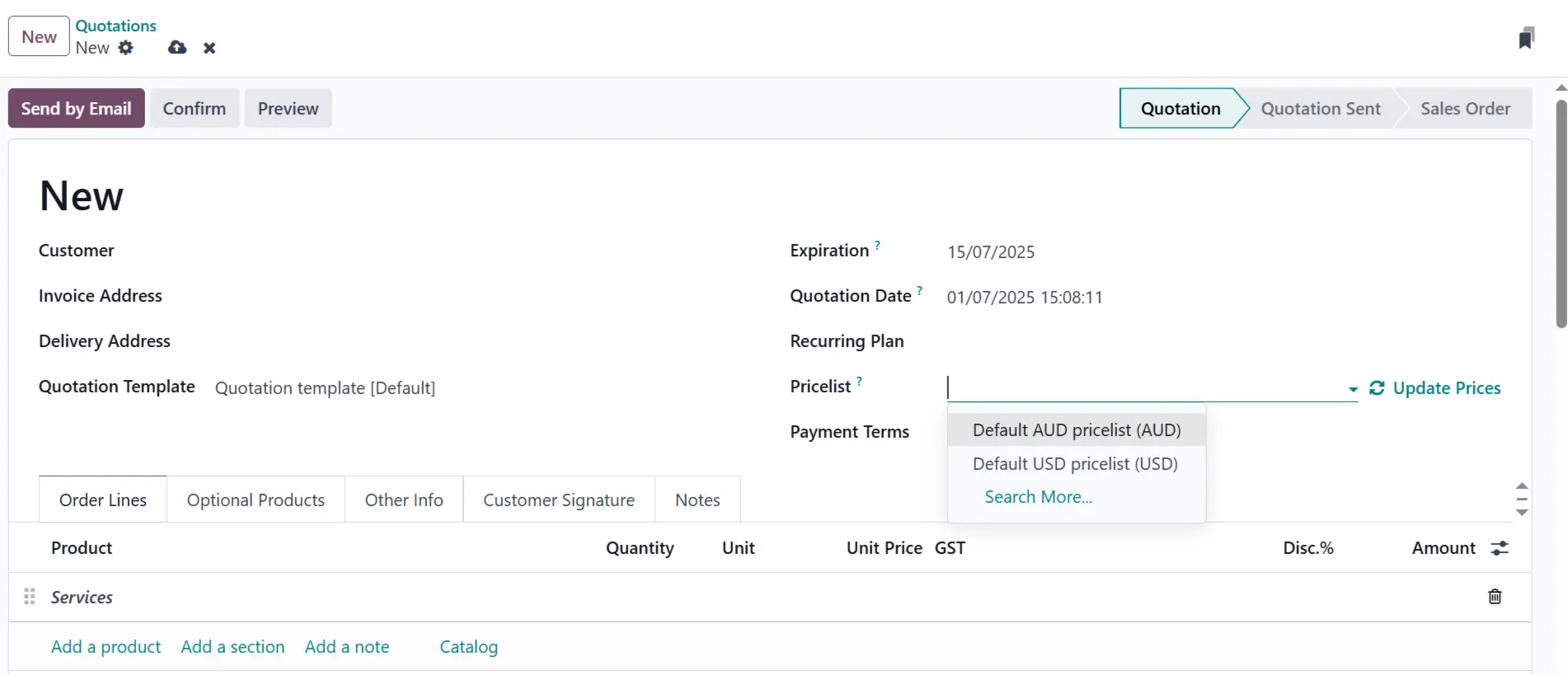

When creating a new quotation or invoice:

- Find the Pricelist field in the document.

- Select the one that matches your desired currency (e.g. Default AUD pricelist).

Odoo will then automatically:

- Display product prices in the selected currency,

- Apply the current exchange rate to convert into your base currency (e.g. AUD),

- Reflect all values correctly in reports and journals.

By setting up your system correctly — activating relevant currencies, creating dedicated pricelists, and enabling automatic rate updates — you lay the groundwork for clean financial data, faster workflows, and better visibility across international operations.

Get in touch with us: